Browsing the Enrollment Refine for Medicare Benefit Insurance Coverage

As people come close to the phase of thinking about Medicare Advantage insurance coverage, they are fulfilled with a labyrinth of options and laws that can in some cases feel overwhelming. Allow's discover how to effectively navigate the enrollment procedure for Medicare Benefit insurance.

Eligibility Demands

To certify for Medicare Advantage insurance, individuals need to fulfill specific eligibility demands detailed by the Centers for Medicare & Medicaid Provider (CMS) Qualification is primarily based on elements such as age, residency condition, and registration in Medicare Component A and Component B. The majority of individuals aged 65 and older qualify for Medicare Advantage, although specific people under 65 with qualifying specials needs might likewise be qualified. Additionally, people must reside within the service location of the Medicare Benefit plan they want to register in.

In addition, individuals should be signed up in both Medicare Part A and Part B to be eligible for Medicare Benefit. Medicare advantage plans near me. Medicare Benefit strategies are called for to cover all solutions supplied by Original Medicare (Part A and Component B), so registration in both components is needed for individuals seeking coverage with a Medicare Advantage plan

Insurance Coverage Options

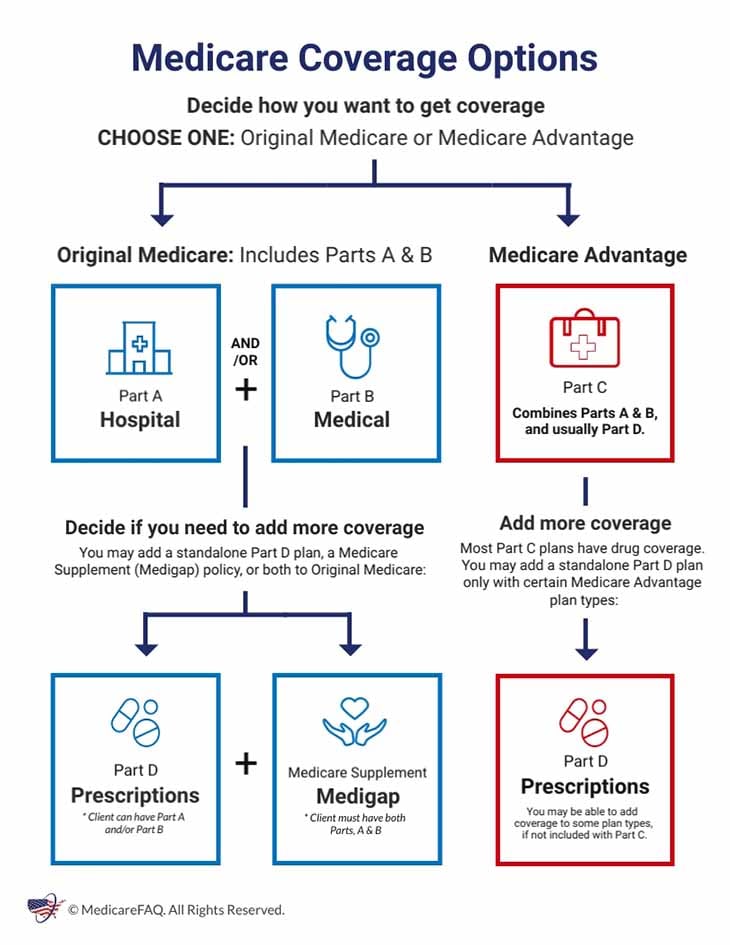

Having actually satisfied the eligibility needs for Medicare Benefit insurance coverage, individuals can now check out the different protection choices offered to them within the strategy. Medicare Advantage prepares, additionally called Medicare Component C, supply an "all-in-one" alternative to Original Medicare (Component A and Component B) by giving fringe benefits such as prescription medicine coverage (Component D), vision, dental, hearing, and health programs.

One of the primary protection alternatives to consider within Medicare Benefit intends is Wellness Upkeep Organization (HMO) strategies, which generally need individuals to choose a main treatment doctor and obtain recommendations to see professionals. Special Demands Plans (SNPs) provide to individuals with particular health and wellness conditions or those who are dually qualified for Medicare and Medicaid.

Recognizing these coverage alternatives is critical for individuals to make educated choices based upon their medical care needs and preferences.

Enrollment Durations

Steps for Enrollment

Comprehending the enrollment periods for Medicare Advantage insurance policy is critical for recipients to browse the procedure successfully and effectively, which starts with reference taking the required steps for enrollment. The primary step is to establish your eligibility for Medicare Advantage. You need to web link be registered in Medicare Part A and Part B to receive a Medicare Benefit strategy. Once qualification is confirmed, study and contrast available strategies in your area. Think about variables such as costs, deductibles, copayments, insurance coverage options, and provider networks to select a plan that best fits your health care requires.

You can enlist straight with the insurance policy firm offering the plan, through Medicare's internet site, or by speaking to Medicare straight. Be certain to have your Medicare card and personal details prepared when registering.

Tips for Choice Making

When evaluating Medicare Benefit prepares, it is vital to carefully assess your private healthcare requirements and financial factors to consider to make an informed choice. To assist in this process, think about the adhering to pointers for choice making:

Contrast Plan Options: Study offered Medicare Advantage prepares in your area. Compare their expenses, protection benefits, provider networks, and high quality scores to figure out which aligns ideal with your requirements.

Think About Out-of-Pocket Costs: Look beyond the month-to-month premium and think about factors like deductibles, copayments, and coinsurance. Determine potential annual expenditures based on your healthcare use to discover one of the most economical alternative.

Evaluation Star Ratings: Medicare assigns star scores to Benefit prepares based on factors like customer fulfillment and top quality of care. Choosing a highly-rated plan might suggest better overall performance look at more info and solution.

Conclusion

To conclude, understanding the qualification needs, protection choices, registration periods, and steps for enrolling in Medicare Benefit insurance policy is vital for making informed decisions. By navigating the enrollment procedure effectively and considering all offered info, people can ensure they are choosing the finest plan to fulfill their medical care needs. Making informed choices throughout the registration procedure can cause much better health results and financial safety and security over time.